Press release

20/05/25

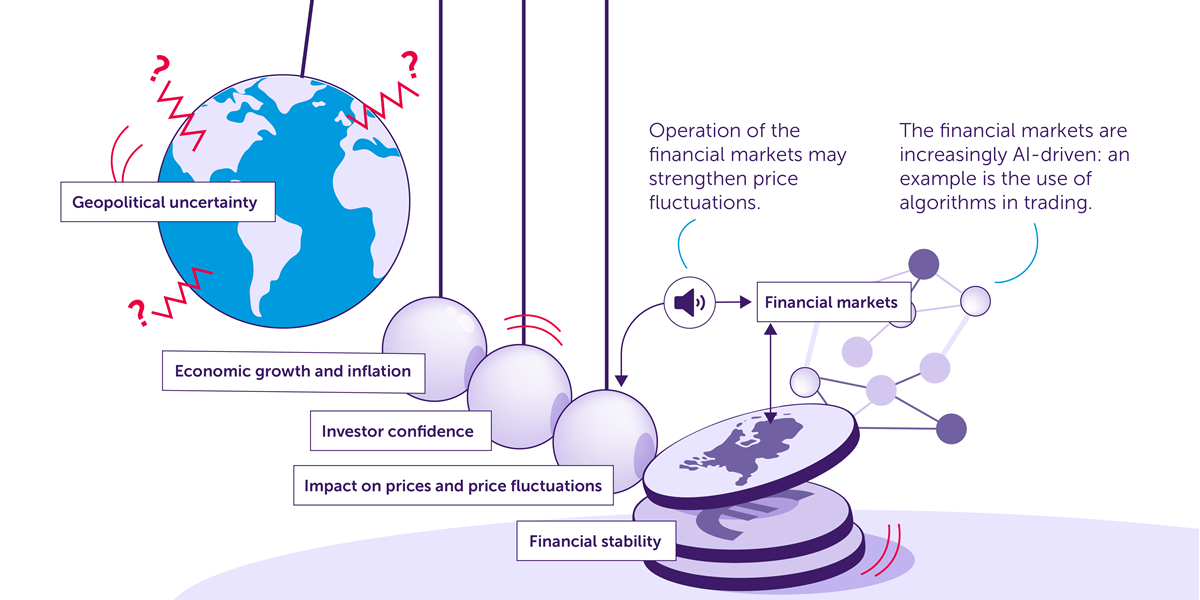

AFM: Higher uncertainty and volatility in financial markets due to geopolitical tensions

In its annual Financial Stability Report, the Dutch Authority for the Financial Markets (AFM) notes that the current geopolitical environment is causing higher uncertainty in the financial markets. Expectations of growth and inflation have become highly uncertain, there are concerns about a possible recession and capital markets are facing increased volatility. The AFM sees further risks to financial stability in the areas of cybersecurity, AI, liquidity and the housing market. In these unpredictable times, it is important that financial institutions and households are well-informed and well-prepared to counter risks.In short

- Geopolitical developments pose a risk to financial stability

- Increasing digitisation requires attention to cybersecurity and AI

- Liquidity risks have remained contained so far, but may return in the event of new market stress

- Housing affordability has deteriorated, continued attention needed for climate risks

Geopolitical developments pose a risk to financial stability

‘The unrest in the world due to international political developments poses a risk to financial stability in the Netherlands. The developments in the United States also affect us strongly due to the interconnectedness of our financial markets and the dependence on American financial institutions and infrastructure. Working together in supervision is no longer self-evident,’ said Laura van Geest, Chair of the AFM. ‘All this underlines the importance of European cooperation and further development of European capital markets. Now is the time to deliver on the promise of a true EU single market.’Increasing digitisation requires attention to cybersecurity and AI

Due to the ongoing digitisation of processes in the financial sector, cybersecurity has become crucial. Especially in light of the current geopolitical situation, in which cyber attacks may increase, it is important that institutions are digitally and operationally resilient. New European regulation (the Digital Operational Resilience Act) contribute to this and the AFM has been supervising the implementation since January 2025.Furthermore, developments in the field of AI are moving at lightning speed, resulting in possible risks for financial institutions and capital markets. The use of algorithms and AI can offer benefits that promote efficiency, but at the same time requires more attention to institutions’ risk management.

Liquidity risks have remained contained so far, but may return in the event of new market stress

Volatility in the stock markets has been higher since the announcement of the US trade tariffs. This has not led to major liquidity problems at financial institutions so far. However, investors, including pension funds, have suffered substantial losses during this period. Due to the high volatility and uncertainty in financial markets, managers of investment funds continue to face increased liquidity risks from capital outflows and margin calls. It is important that they manage these risks and take appropriate measures. It is also good to review the stress test policy, including the scenarios used, in the light of the past stress period.Housing affordability has deteriorated, continued attention needed for climate risks

The ever-rising house prices result in a deterioration of the affordability of housing, although it seems to be stabilising. The high demand for housing and the limited supply remain decisive in this regard. Excessive mortgage debt poses a risk to households, despite fixed interest rates that partly mitigate this. Policy and behaviour of lenders, advisors and appraisers must prevent the housing market from overheating further.Climate risks, such as foundation damage, may also not be sufficiently taken into account when valuing homes. It is therefore essential to provide households with adequate information on this. However, the current dynamics in the housing market cause more outbidding and no inclusion of a financing clause or a home inspection contingency.

Contact for this article

Charlene Zikmund

charlene.zikmund@afm.nl

+31 6 29 42 08 87

+31 6 29 42 08 87

Would you like to receive the latest news from AFM?

Subscribe to our newsletter, we will keep you up-to-date.