Sustainability reporting and the Corporate Sustainability Reporting Directive (CSRD)

The Corporate Sustainability Reporting Directive (CSRD) gives investors, consumers, and other users of annual reports insight into the impact, opportunities and risks in the field of sustainability. Stakeholders can, therefore, assess whether a companies sustainability practices align with their own norms and values and make more informed decisions when investing in, purchasing from, or engaging with a company in any economically meaningful way. It also provides input for the strategic direction of a company. With the CSRD fostering greater transparency, it is to be expected that companies will generally adopt more sustainability practices.

CSRD: transparency on environmental and social aspects

Transitioning to a sustainable society is more pressing than ever. The European Union has issued several important policies and regulations to accelerate the sustainability transition. Among these polices and regulations, the CSRD, as the successor to the Non-financial Reporting Directive (NFRD), stands out. The CSRD enables companies to gain (and provide) insight into their impact on people and the environment, as well as the associated opportunities and risks.

The CSRD requires companies to report more extensively and specifically on sustainability matters, based on the European Sustainability Reporting Standards (ESRS). It also requires that a statutary auditor or assurance provider offers limited assurance on the non-financial information prepared in accordance with the ESRS.

Omnibus proposal

The CSRD applies to all countries in the European Union and needs to still be officially implemented into the Dutch legislation. On February 2025, the European Commission expressed, in an Omnibus Proposal, intentions to simplify and streamline reporting requirements for sustainability practices. This will reduce the level of detail and the scope of the CSRD reporting requirements. It is yet unknown when amendments will be made and when the CSRD will be passed by the Dutch parliament.

Transition plan

The implementation of the CSRD will take place in stages, depending on the size of the companies. However, due to the Omnibus Proposal, the exact timeline for its enforcement and the companies it will apply to have yet to be determined. Given the uncertainties, preparing for the implementation of the CSRD requirements remains a challenge. The AFM remains committed to a transition plan and encourages a cooperative approach between companies and auditors to improve CSRD preparations in joint efforts.

Recent publications

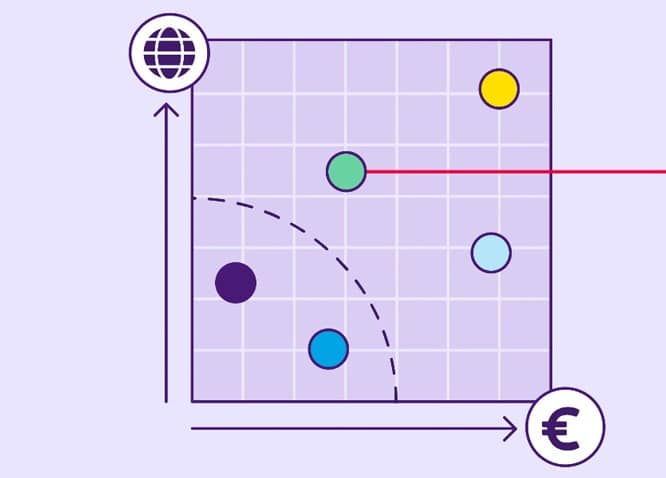

As part of the CSRD preparations, the AFM has shared the following publications:- The company and its place in the world: 3 focuspoints for CSRD (July '25)

- Ten waypoints for CSRD - Double Materiality (Jul ’24)

- Net-zero targets require courage (Feb ’24)

- No time to lose! (Mar ‘23)

View the report

The 10 steps to consider for the double materiality analysis (July 2024) support large listed companies in preparing for the CSRD. Please note that at the time the report was published, the Omnibus proposal was not yet announced.