Press release

08/06/23

More rigorous stance needed by auditors in fraud risk analysis

Auditors are aware that a critical mindset to detect fraud is important but can apply this much more rigorously in practice. This is of great importance for the public interest. The mandatory steps in the fraud risk analysis are followed, but this often happens too superficially. This is the AFM’s conclusion of the review ‘More attention for fraud risks!’ In 27 of the 32 examined statutory audits, one or more findings were observed in the fraud risk analysis.In brief

- Proper identification of fraud risks is the core task of auditors

- Obvious fraud risks not recognised in half of the reviewed audits

- Mandatory steps in fraud risk analysis are adhered to, but depth should be improved

- False start of the statutory audit without more rigorous fraud risk analysis, new review in 2024

Proper identification of fraud risks is the core task of auditors

Fraud in companies can have a major impact on the public interest and, for example, lead to extensive damage for investors and other stakeholders of the company. Identifying and monitoring fraud risks at companies that require an audit is the core task of the auditor. The auditor makes a fraud risk analysis upfront, so that it is clear which areas should receive additional attention during the audit. If the fraud risk analysis is not performed adequately, it is more likely that possible fraud will be missed. That is why the AFM has reviewed the quality of the fraud risk analysis in 32 statutory audits.Obvious fraud risks not recognised in half of the reviewed audits

For example, the assumed risk of fraud in revenue recognition is often not recognised. Also, the risk that management itself commits fraud is often not specified.Mandatory steps in fraud risk analysis are adhered to, but depth should be improved

The AFM observes that the steps required to arrive at a proper fraud risks assessment are taken, but this often takes place too superficially. Reasoning often takes place as to why there are no fraud risks, rather than a close examination of how fraud risks can occur. This is the other way around.False start of the statutory audit without rigorous fraud risk analysis, new review in 2024

Hanzo van Beusekom, AFM board member responsible for overseeing audit firms: ‘A statutory audit has a false start when the fraud risk analysis upfront it is performed superficially. It is better to improve matters now, rather than having to deal with a conflagration later on.’ In 2024, the AFM will again review how audit firms deal with fraud. This will remain a recurring topic for the AFM.

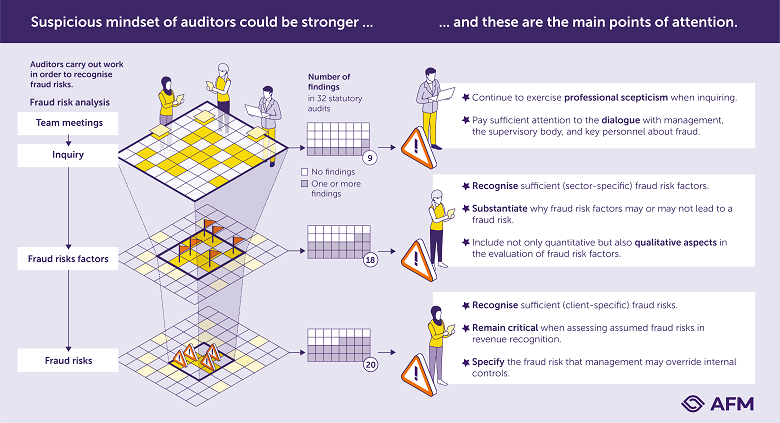

Explanation of the visual

In this visual, we show the number of findings and the key focal points for each component in the fraud risk analysis.

Accountants' investigative mindset can be sharper, and these are the main focal points:

In the fraud risk analysis, accountants perform procedures to identify fraud risks.

Team discussions and gathering of information: 9 findings in 32 statutory audits.

Maintain a professionally skeptical approach when gathering information. Pay sufficient attention to dialogues with management, supervisory bodies, and key personnel regarding fraud.

Identifying and evaluating fraud risk factors: 18 findings in 32 statutory audits.

Recognize an adequate number of (sector-specific) fraud risk factors. Justify why certain fraud risk factors do or do not result in a fraud risk. Consider not only quantitative but also qualitative aspects when evaluating fraud risk factors.

Identifying and assessing fraud risks: 20 findings in 32 statutory audits.

Identify an adequate number of (client-specific) fraud risks. Maintain a critical approach when assessing assumed fraud risks related to revenue recognition. Make the fraud risk that bypasses management's internal control measures specific.Tags

Audit firmsContact for this article

Daniëlle de Jong

danielle.de.jong@afm.nl

+31 6 49 97 87 77

+31 6 49 97 87 77

Would you like to receive the latest news from AFM?

Subscribe to our newsletter, we will keep you up-to-date.