AFM annual report 2022: a call to keep an eye on the long term

A succession of crises should not distract us from making plans and policy for the long term. This is the key message from AFM Chair Laura van Geest in presenting the 2022 annual report of the Dutch Authority for the Financial Markets (AFM). ‘It seems that crises have become a constant in our lives, and we are right to focus on taking quick and decisive action to address them. But if you want to chart a clear course, you need to set long-term goals.’

Summary

- Long-term policy brings stability to the financial markets

- AFM prioritises supervision of green claims made for financial products

- Increasing digitalisation in insurance

- AFM fine-tunes its pension supervision

The AFM looks back on a year that started with a sense of optimism because of the ending of the coronavirus pandemic. But the sentiment shifted quickly after the invasion of Ukraine, a huge spike in gas prices and record inflation. The AFM also saw the impact of this on the financial markets in the past year. Interest rate hikes by the central banks led to a repricing of risks, leading to a drop in house prices and increased volatility in the capital markets.

In these times of turbulence, which includes the recent anxiety in the financial markets due to the problems at banks in the US and Switzerland, the AFM Chair points to the importance of keeping an eye on the long term. ‘Predictability contributes to stability. Stability boosts confidence, which brings prosperity, also here in the Netherlands’, says Laura van Geest. ‘If we don’t plan for the long term, such as when it comes to digitalisation, we will end up being surprised by future developments. Issues can then suddenly turn into real problems and we will be lagging behind. And least-ditch efforts rarely yield good outcomes.'

Digitalisation

The AFM recently explored what the insurance market might look like in ten years’ time. Our researchers expect that digitalisation and the use of data could lead to insurance becoming highly personalised. This offers advantages such as better service, a more personalised offering and more choice. But at the same time, the researchers warn (pdf, 4.1 MB) that consumers may become more vulnerable and in extreme cases even uninsurable. The increasing market share of foreign parties means that European supervision will become even more important.

Sustainability

Sustainability, and transparency from companies on this topic, is a point of attention for the AFM. The AFM has recently reviewed the basis for many of the green claims made by businesses that offset their polluting emissions by buying carbon credits. These credits, through which polluting CO2 emissions are compensated for by means of carbon reduction elsewhere, frequently turn out to be insufficiently substantiated, according to the researchers. In addition, the AFM points out (pdf, 4.1 MB) that the amount of CO2 that can be traded is not unlimited. The amount of carbon that can be removed from the atmosphere and sequestered somewhere else is finite. The AFM observes that companies do not seem to be aware of this issue yet, nor is this issue reflected in the prices that are calculated for carbon credits.

Pensions

The Dutch Senate will soon vote on the new pension system. The supervision of the transition to the new system in the pension sector that is already under way will be a key priority in the year ahead. 2022 saw the preparations for this transition, with the publication of various guidelines, such as our provisional document on decision-making guidance for participants. Recently, we also published our guidance on communication plans. This year, the AFM will focus on monitoring whether the sector is acting in accordance with our guidance.

Annual report

In its annual report, which include its financial statements, the AFM describes its activities and the results achieved in 2022. This is also the first year in which our social annual report (in Dutch) on our employees and our social policy has been published.

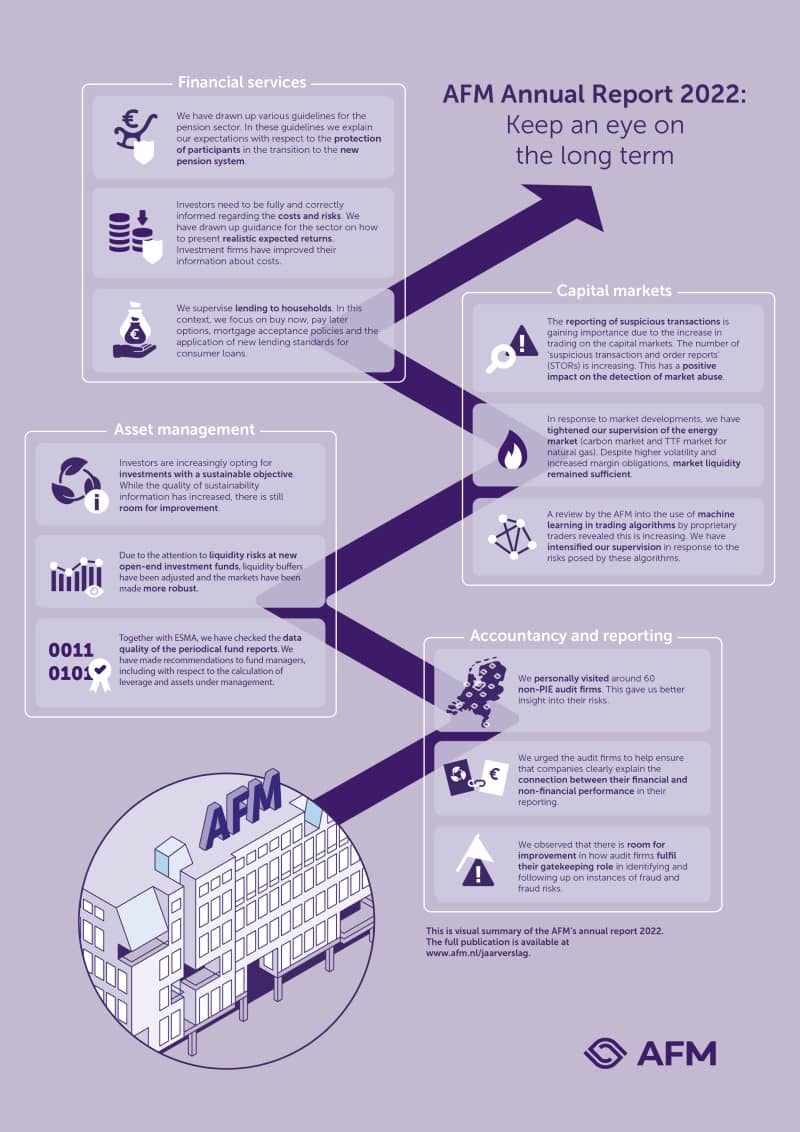

This infographic highlights the key focus points for 2022.

Financial services

- In preparation for the new pension system, we have developed various guidelines for the sector, clarifying our expectations regarding participant protection.

- Providing accurate and complete information is important for investors. We have provided guidance to help achieve realistic expected returns for asset management and investment advice. Investment firms have improved their cost information.

- We have also focused on the opportunities and risks of deferred payment, reviewed acceptance policies for mortgage lending, and examined the application of new borrowing standards for consumer credit.

Capital markets

- We have also focused on the opportunities and risks of deferred payment, reviewed acceptance policies for mortgage lending, and examined the application of new borrowing standards for consumer credit.

- Due to market developments, we have intensified our supervision of the energy market (carbon and TTF gas). Despite increased volatility and margin requirements, there was still sufficient liquidity in the market.

- Our survey of Proprietary Traders showed that machine learning is increasingly being used in trading algorithms. Given the risks of these algorithms, we have intensified our supervision.

Asset management

- Investors are increasingly choosing investments with a sustainable objective. Although the quality of sustainability information is improving, there is still room for improvement.

- By focusing on the management of liquidity risks at open-ended investment institutions, we contribute to strengthening market robustness.

- Together with ESMA, we have checked the data quality of periodic fund reports. We have made recommendations to managers regarding the calculation of leverage and assets under management.

Accounting and reporting

- We personally visited about 60 accounting organizations with a regular license, which gave us more insight into risks.

- We advocate for a good connection between financial and non-financial performance by listed companies in their reporting.

- We have found that accounting organizations can do even better in their gatekeeper role in identifying and following up on fraud (risks).

Contact for this article

Would you like to receive the latest news from AFM?

Subscribe to our newsletter, we will keep you up-to-date.